As the debate over whether Bitcoin is money continues to rage on, it is important to explore different perspectives and arguments on the matter. The following articles provide valuable insights and analysis on this topic, shedding light on the various factors that contribute to the ongoing discussion.

The Case for Bitcoin as a New Form of Money

Bitcoin has been making waves in the world of finance as a potential new form of money. With its decentralized nature, limited supply, and high level of security, many experts are touting it as the currency of the future.

One of the key arguments for Bitcoin as a new form of money is its scarcity. Unlike traditional fiat currencies that can be printed endlessly by central banks, Bitcoin has a fixed supply of 21 million coins. This limited supply is built into the protocol and ensures that no one can manipulate the value of Bitcoin by flooding the market with new coins.

Another compelling case for Bitcoin is its security. Transactions on the Bitcoin network are secured by cryptography and recorded on a public ledger called the blockchain. This makes it virtually impossible for hackers to counterfeit or double-spend Bitcoin, providing a level of security that is unmatched by traditional payment systems.

Bitcoin has also gained popularity among high-profile investors and celebrities. Tesla CEO Elon Musk has been a vocal supporter of Bitcoin, even investing

As the debate over whether Bitcoin is money continues to rage on, it is important to explore different perspectives and arguments on the matter. The following articles provide valuable insights and analysis on this topic, shedding light on the various factors that contribute to the ongoing discussion.

.5 billion in the cryptocurrency through his company. Other notable figures such as billionaire investor Paul Tudor Jones and rapper Snoop Dogg have also expressed their support for Bitcoin as a new form of money.Overall, the case for Bitcoin as a new form of money is strong. Its scarcity,

Challenges and Opportunities in Defining Bitcoin as Money

In the rapidly evolving landscape of digital currencies, Bitcoin has emerged as a revolutionary force that challenges traditional notions of money. The debate surrounding whether Bitcoin should be classified as money is a complex and multifaceted issue that presents both challenges and opportunities.

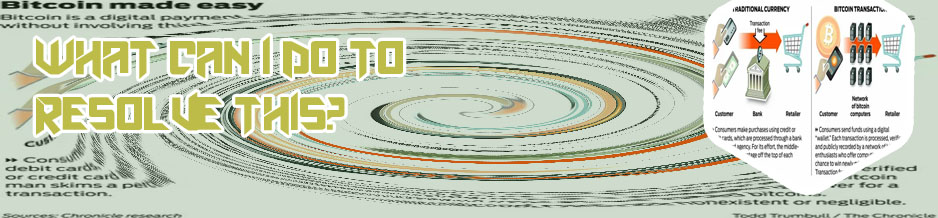

One of the key challenges in defining Bitcoin as money lies in its decentralized nature. Unlike traditional fiat currencies that are issued and regulated by governments, Bitcoin operates on a peer-to-peer network that is not controlled by any central authority. This raises questions about its legitimacy and stability as a medium of exchange.

On the other hand, Bitcoin also presents unique opportunities as a form of money. Its borderless and censorship-resistant nature allows for seamless global transactions, making it an attractive option for individuals and businesses looking to bypass traditional financial institutions. Additionally, the underlying blockchain technology offers unparalleled security and transparency, further enhancing Bitcoin's appeal as a viable alternative to traditional currencies.

In conclusion, the debate over whether Bitcoin should be classified as money highlights the disruptive potential of this innovative digital asset. As the world continues to grapple with the implications of the digital revolution, understanding the challenges and opportunities associated with defining Bitcoin as money is crucial for shaping the future of finance.