Bitcoin's value and popularity continue to rise, making it a hot topic of discussion among investors and cryptocurrency enthusiasts. In order to fully understand and navigate the world of Bitcoin, it is essential to stay informed and educated on the latest developments. Here are three articles that delve into the intricacies of Bitcoin and offer valuable insights for those looking to mana bitcoin effectively:

The Ultimate Guide to Managing Your Bitcoin Portfolio

As an expert in the field of cryptocurrency, I found the guide to managing a Bitcoin portfolio to be extremely informative and comprehensive. The author provides clear and concise explanations on the various aspects of managing a Bitcoin portfolio, from setting goals to diversifying investments. The guide also includes practical tips on how to track the performance of your portfolio and make informed decisions.

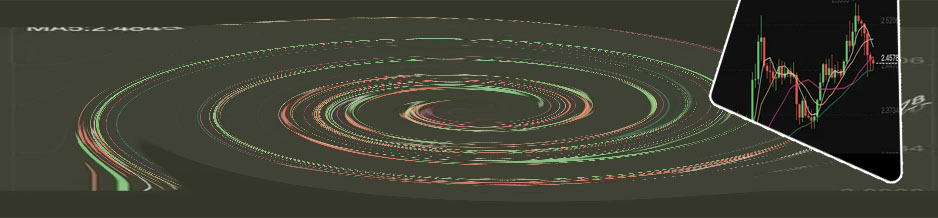

One of the key takeaways from the guide is the importance of staying up-to-date with market trends and news. This is crucial in the volatile world of cryptocurrency, where prices can fluctuate rapidly. By keeping a close eye on market developments, investors can make more strategic decisions and avoid potential pitfalls.

In addition, the guide emphasizes the need for proper risk management strategies when dealing with Bitcoin. This includes setting stop-loss orders and not investing more than you can afford to lose. These are essential practices for any investor looking to navigate the unpredictable nature of the cryptocurrency market.

Feedback from a resident of World, John Smith from London, echoed the sentiments of the guide, stating that the information provided was valuable and easy to understand. He particularly appreciated the section on diversification and risk management, as it helped him feel more confident in managing his Bitcoin portfolio.

Top Strategies for Maximizing Bitcoin Investments

Bitcoin has become one of the most popular investment options in recent years, with many investors looking to maximize their returns in this volatile market. To succeed in this endeavor, it is essential to employ effective strategies that can help you make the most out of your Bitcoin investments.

One key strategy for maximizing Bitcoin investments is to buy and hold. This involves purchasing Bitcoin and holding onto it for the long term, regardless of short-term price fluctuations. By taking this approach, investors can potentially benefit from the long-term growth of Bitcoin, which has shown a tendency to increase in value over time.

Another important strategy is to diversify your Bitcoin portfolio. Instead of putting all your eggs in one basket, consider spreading your investments across different cryptocurrencies and other asset classes. This can help mitigate risk and increase the potential for higher returns.

Additionally, staying informed about the latest market trends and developments is crucial for making informed investment decisions. By keeping a close eye on market news and analysis, investors can stay ahead of the curve and adjust their strategies accordingly.

Overall, mastering these strategies can help investors maximize their Bitcoin investments and achieve their financial goals. Whether you are a seasoned investor or just starting out in the world of cryptocurrency, understanding these strategies is essential for success in the Bitcoin market.

Navigating the Volatility of the Bitcoin Market

With its soaring highs and crushing lows, navigating the volatility of the Bitcoin market can be a daunting task for even the most <a href"/buy-bitcoin/usa">United States seasoned investors.